EDUCATION

Bursaries and scholarships cannot be substituted by student loans

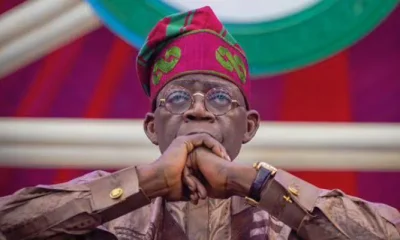

President Bola Tinubu has endorsed the continuation of the student loan initiative initiated by his predecessor, following the recent repeal of the 2023 Student Loan Act and his signing of the 2024 Student Loan Bill. While the new law aims to address some shortcomings of the previous act, concerns persist regarding its intricacies.

The new law establishes the Nigerian Education Loan Fund as a fully operational body corporate tasked with providing loans to eligible Nigerians, covering tuition, fees, charges, and living expenses. The fund will oversee 1.0 per cent of all taxes and levies accruing to the Federal Government.

In contrast to the repealed version, the new law removes the N500,000 family income barrier, eliminates the requirement for a guarantor and the parent’s loan history prerequisite.

It encompasses students pursuing vocational, development, or skill-acquisition programs. However, the policy retains the provision of a three-year jail term for felony for defaulters, with repayment expected to commence two years post-National Youth Service Corps.

Despite these amendments, skepticism persists. Concerns have been raised that the scheme aims to rationalize recent tuition fee hikes and discontinue scholarships, grants, and bursaries for deserving and financially disadvantaged students.

No credible government should substitute scholarships, bursaries, and grants with student loans. Furthermore, the limited moratorium on the loans poses challenges for students unable to secure employment promptly,

potentially leading to debt accumulation and the risk of imprisonment, especially given the scarcity of decent job opportunities in Nigeria. Currently, the minimum wage stands at N30,000 per month, and the law provides for debt forgiveness in the event of death.

In contrast, unemployed individuals in the United Kingdom receive government support through the Jobseeker Allowance until they secure employment, a safety net lacking in Nigeria. Additionally, in the 1980s, students studying Education courses received bursaries from both state and federal governments, a practice that should be reinstated.

Nigerian undergraduates are grappling with a significant increase in tuition fees coinciding with the introduction of the Student Loan Bill in 2023. The rationale behind the scheme, including university financial autonomy and addressing poor funding, undermines the objective of providing education to financially disadvantaged Nigerians.

This has sparked protests and raised concerns about increased dropouts, suggesting that the government may be moving away from financing tertiary education, a decision that contradicts the fundamental role of education in societal development.

Student loans can pose a quagmire, as evidenced by the situation in the United States, where approximately 44 million borrowers owe $1.7 trillion in student loan debt.

Despite the potential for university degrees to lead to high-paying jobs, student loan debt and other accrued debts diminish the overall standard of living for borrowers.

In response, the Joe Biden administration recently signed an executive order to forgive up to $20,000 of Pell Grant loans and $10,000 of non-Pell grants for individuals earning less than $125,000 per year.

Nigeria has a checkered history with student loans, as documented in a 1992 paper in Higher Education. The Federal Government established student loan boards at various times, but loan recovery and repayments were reportedly disappointing.

Therefore, Nigeria must learn from past experiences and other countries where student loans have hindered progress.

Instead of solely relying on the loan scheme, the federal and state governments should prioritize investment in scholarships, grants, and bursaries, particularly in fields with a demand for skilled personnel such as teaching, the sciences, technology, engineering, and medicine.

You must be logged in to post a comment Login