BUSINESS

Tesla Stock Soars 12% Overnight, Reaches Highest Price Since July 2023

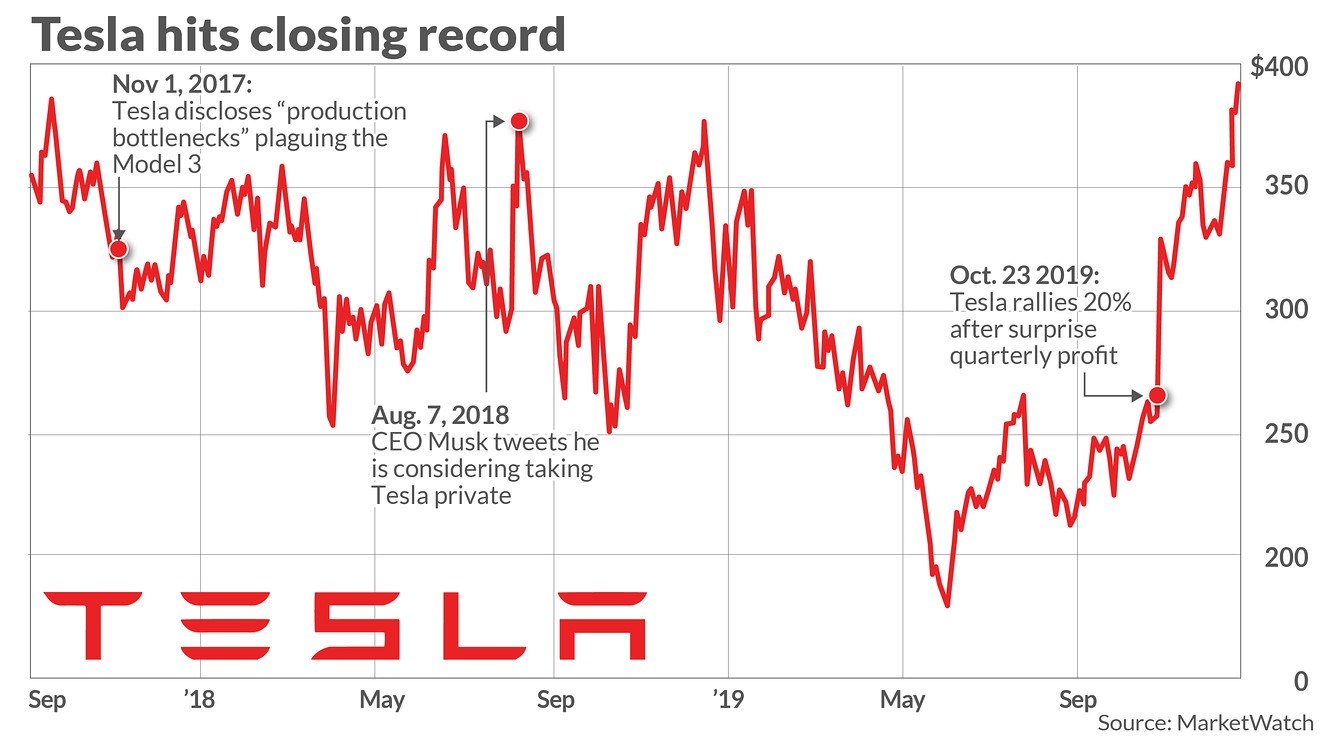

Tesla’s stock has made a remarkable surge, soaring more than 12% overnight and reaching its highest price since July 2023. This dramatic increase has caught the attention of investors and market analysts alike, marking a significant milestone for the electric vehicle (EV) giant.

The price spike can be attributed to a combination of factors, including strong quarterly earnings reports, positive news about the company’s growth in international markets, and investor optimism surrounding the future of electric vehicles and clean energy. Tesla’s performance in the stock market reflects a broader trend in which investors are increasingly confident in the company’s ability to maintain its dominance in the rapidly evolving EV space.

One key catalyst for Tesla’s recent rally is the growing demand for electric vehicles, especially in key markets like China, Europe, and North America. As governments around the world implement stricter emissions regulations and provide incentives for EV adoption, Tesla is well-positioned to capitalize on this shift toward sustainable transportation.

Moreover, Tesla has made strategic investments in expanding its production capacity, including the construction of new Gigafactories in regions like Texas and Germany. These investments have helped alleviate some of the supply chain constraints that previously hampered the company’s ability to meet growing demand, and have fueled optimism that Tesla can continue to scale its operations effectively.

Another factor driving Tesla’s stock price is its impressive financial performance. In its latest earnings report, Tesla exceeded market expectations, posting higher-than-expected revenue and profitability. The company’s ability to maintain healthy margins despite increasing competition from both traditional automakers and new EV startups has further bolstered investor confidence.

Tesla’s commitment to reducing costs through innovations in manufacturing and battery technology has also positioned it as a leader in the EV industry, making it an attractive long-term investment for those seeking exposure to the clean energy and technology sectors.

Despite the recent price surge, Tesla’s stock remains highly volatile, reflecting the broader challenges and uncertainties in the market. Investors are closely watching for signs of slowing growth or any disruptions in production or supply chains, especially as competition in the EV space heats up.

Nonetheless, Tesla’s upward momentum signals that, for now, the company is firmly entrenched in its role as one of the most valuable and influential firms in the world. As the EV market continues to grow, Tesla’s ability to innovate and adapt will be crucial in maintaining its position as a market leader and continuing to drive shareholder value.

You must be logged in to post a comment Login