NIGERIA NEWS

Tinubu to Sign Landmark Tax Reform Bills on Thursday

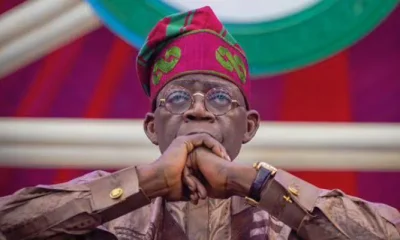

President Bola Tinubu is set to sign four major tax reform bills into law on Thursday, marking a significant step toward overhauling Nigeria’s fiscal and revenue administration framework.

The bills—Nigeria Tax Bill, Nigeria Tax Administration Bill, Nigeria Revenue Service (Establishment) Bill, and Joint Revenue Board (Establishment) Bill—were recently passed by the National Assembly. According to a statement issued Wednesday by the President’s Special Adviser on Information and Strategy, Bayo Onanuga, the legislative package is expected to streamline tax systems, enhance compliance, and attract investment.

“These laws are groundbreaking and will significantly transform tax administration in the country,” Onanuga said. “They will improve revenue generation, create a more predictable fiscal environment, and ease the burden of tax compliance for businesses and individuals.”

Key highlights of the bills include:

-

Nigeria Tax Bill (Ease of Doing Business): Consolidates Nigeria’s fragmented tax laws into a single harmonised statute, eliminating duplications and reducing the multiplicity of taxes.

-

Nigeria Tax Administration Bill: Establishes a uniform legal and operational tax framework across federal, state, and local governments to improve consistency and coordination.

-

Nigeria Revenue Service (Establishment) Bill: Replaces the Federal Inland Revenue Service (FIRS) with a new, autonomous Nigeria Revenue Service (NRS), with an expanded mandate that includes non-tax revenue collection and stronger accountability mechanisms.

-

Joint Revenue Board (Establishment) Bill: Creates a formal governance structure for intergovernmental cooperation among tax authorities and introduces key oversight tools, including a Tax Appeal Tribunal and an Office of the Tax Ombudsman.

The reforms are part of President Tinubu’s broader economic agenda aimed at improving Nigeria’s business climate, boosting investor confidence, and increasing the efficiency of public revenue collection.

You must be logged in to post a comment Login